When it comes to hard money lending, evaluating a borrower’s experience and track record is crucial for lenders to determine the level of risk involved in extending a loan. By assessing the borrower’s past performance and expertise in relevant industries, hard money lenders gain insights into their ability to successfully manage a project and repay the loan. This article explores the various factors that hard money lenders consider when evaluating a borrower’s experience and track record, shedding light on the key criteria used to make informed lending decisions.

1. Introduction

When seeking financing for real estate investments, borrowers often turn to hard money lenders as an alternative to traditional lenders such as banks. Hard money lenders specialize in providing short-term loans for real estate investments, using the property itself as collateral. In order to mitigate their risk, these lenders carefully evaluate the borrower’s experience and track record in the industry. This article will explore why hard money lenders place such importance on a borrower’s experience and track record, as well as the specific factors taken into consideration during the evaluation process.

2. Understanding Hard Money Lenders

2.1 Definition of Hard Money Lenders

Hard money lenders are private individuals or companies that offer short-term loans to borrowers, typically for real estate investments. Unlike traditional lenders, hard money lenders base their decision on the value of the property and the borrower’s ability to repay rather than relying heavily on the borrower’s creditworthiness. These loans are often used for fix-and-flip projects or other real estate investments with a quick turnaround.

2.2 Role of Hard Money Lenders in the Real Estate Market

Hard money lenders play a vital role in the real estate market by providing alternative financing options for borrowers who may not qualify for traditional bank loans. Their flexibility and quick turnaround times make them attractive to borrowers who require financing for time-sensitive projects or who have less-than-stellar credit. By evaluating the borrower’s experience and track record, hard money lenders can assess the level of risk associated with the investment and make an informed lending decision.

2.3 Why Borrowers Opt for Hard Money Loans

There are several reasons why borrowers opt for hard money loans over traditional bank financing. Firstly, the application process for a hard money loan is typically faster and less stringent than that of a bank loan. This is particularly beneficial for borrowers who need immediate funding to secure a real estate opportunity. Additionally, hard money lenders are more willing to lend on properties in poor condition or in less desirable locations, which may be rejected by traditional lenders. Finally, hard money loans also provide an avenue for borrowers with less-than-perfect credit histories to secure financing for their real estate investments.

3. Importance of Borrower’s Experience and Track Record

3.1 The Significance of Borrower’s Experience

When evaluating a borrower’s qualifications, hard money lenders place great importance on their experience in the real estate industry. A borrower with a solid track record demonstrates their understanding of the complexities and risks associated with real estate investments. This experience helps lenders gauge the borrower’s ability to successfully navigate potential challenges that may arise during the investment process.

3.2 The Impact of Track Record on Loan Approval

In addition to experience, a borrower’s track record in previous real estate investments plays a crucial role in the loan approval process. Hard money lenders look for evidence of successful projects, as this demonstrates the borrower’s ability to execute and generate profits. Conversely, a track record marred by defaults or delinquencies raises concerns about the borrower’s ability to repay the loan and manage the investment effectively.

3.3 Trust and Confidence for Lenders

By evaluating a borrower’s experience and track record, hard money lenders can gain trust and confidence that the borrower is capable of successfully completing the investment. Lenders need to have faith in the borrower’s ability to generate returns on the investment and repay the loan within the agreed-upon timeframe. This trust and confidence are essential for establishing a mutually beneficial relationship between the lender and the borrower.

4. Assessing Borrower’s Experience

4.1 Reviewing Borrower’s Background and Expertise

During the evaluation process, hard money lenders carefully review the borrower’s background and expertise in the real estate industry. Lenders assess the borrower’s educational background, professional certifications, licenses, and any relevant training or qualifications. A borrower with formal education or industry-specific certifications demonstrates a commitment to learning and professional development, which can inspire confidence in the lender.

4.2 Evaluating Previous Real Estate Investments

Hard money lenders also seek to evaluate the borrower’s performance in previous real estate investments. By examining the borrower’s past projects, lenders can assess the success rate of their investments, their ability to identify profitable opportunities, and their skill in managing properties effectively. The results of these evaluations provide lenders with insight into the borrower’s investment strategy and the likelihood of success in future ventures.

4.3 Analyzing Any Previous Defaults or Delinquencies

Defaults and delinquencies are red flags for hard money lenders, as they indicate the borrower’s inability to meet their financial obligations in the past. Lenders scrutinize the borrower’s credit history to identify any instances of late payments, foreclosures, or bankruptcies. While a single instance may not necessarily disqualify a borrower, a pattern of financial mismanagement raises concerns and decreases the likelihood of loan approval.

4.4 Examining Professional Certifications or Licenses

Hard money lenders also consider any professional certifications or licenses the borrower possesses that are relevant to the real estate industry. For example, certifications such as Certified Commercial Investment Member (CCIM) or membership in professional organizations like the National Association of Realtors (NAR) can indicate a higher level of expertise and professionalism. These credentials can instill confidence in lenders regarding the borrower’s knowledge and competence in navigating the complexities of the real estate market.

5. Evaluating Track Record

5.1 Examining Successful Real Estate Projects

Hard money lenders closely examine the borrower’s successful real estate projects to gauge their ability to generate profits. Lenders look for evidence of completed projects with a positive return on investment. This demonstrates the borrower’s ability to identify profitable opportunities, execute effective renovation or development strategies, and generate returns within the desired timeframe.

5.2 Reviewing Financial Statements and Tax Returns

In addition to project-specific evaluations, hard money lenders analyze a borrower’s financial statements and tax returns. Lenders scrutinize these documents to assess the borrower’s overall financial health, including income, debt obligations, assets, and liquidity. A borrower with a strong financial profile is more likely to inspire confidence in lenders and increase the chances of loan approval.

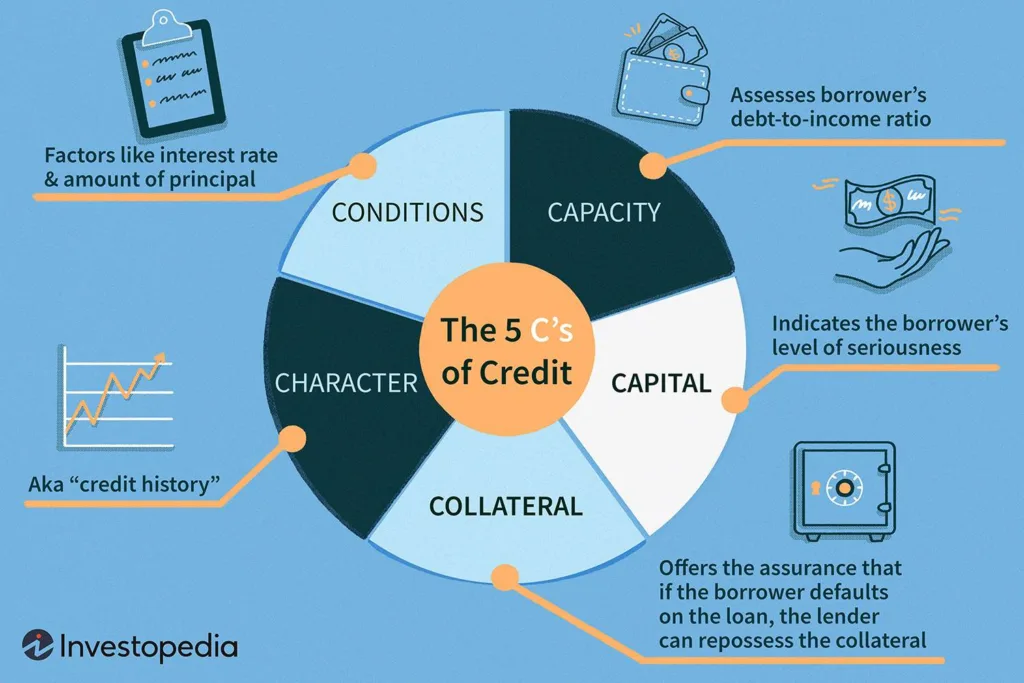

5.3 Verifying Credit History and Score

Credit history and score provide valuable insight into a borrower’s financial responsibility and ability to manage debt. Hard money lenders obtain the borrower’s credit report to evaluate their creditworthiness. A solid credit history and high credit score indicate a borrower’s reliability and promptness in repaying obligations, increasing the lender’s confidence in the borrower’s ability to repay the loan.

5.4 Assessing Debt-to-Income Ratio

The borrower’s debt-to-income (DTI) ratio is another crucial factor considered by hard money lenders. This ratio measures the borrower’s monthly debt obligations against their monthly income. Lenders assess the DTI ratio to determine the borrower’s ability to manage additional debt resulting from the hard money loan. A lower DTI ratio signifies a borrower’s stronger financial position and enhances their chances of loan approval.

6. Considerations for First-Time Borrowers

6.1 Building a Strong Real Estate Team

First-time borrowers can offset their lack of experience by assembling a strong real estate team. Hard money lenders recognize the importance of a cohesive and knowledgeable team in executing successful real estate investments. By including experienced professionals, such as contractors, property managers, or real estate agents, first-time borrowers demonstrate their commitment to surrounding themselves with experts, thus mitigating the perceived risk associated with their limited experience.

6.2 Highlighting Transferable Skills and Knowledge

While first-time borrowers may lack direct experience in real estate investments, they can highlight transferable skills and knowledge gained from other industries or professions. Skills such as project management, financial analysis, negotiation, and problem-solving are valuable assets that can reassure lenders of the borrower’s ability to navigate the complex world of real estate investments.

6.3 Utilizing Guarantors or Co-Signers

First-time borrowers without a substantial track record may consider utilizing guarantors or co-signers to strengthen their loan application. Hard money lenders often require additional assurances when lending to borrowers with limited experience. Having a guarantor or co-signer with a strong financial profile and an established track record in real estate investments can provide the necessary reassurance for lenders and increase the likelihood of loan approval.

6.4 Exploring Joint Venture Opportunities

Another avenue for first-time borrowers is to explore joint venture opportunities with experienced real estate investors. By partnering with an experienced investor, first-time borrowers can leverage their partner’s knowledge and track record to increase their chances of loan approval. Hard money lenders often view joint ventures as a way to mitigate risk, as the experienced partner can provide guidance and support throughout the investment process.

7. Documentation and References

7.1 Importance of Accurate Documentation

Accurate and complete documentation is crucial when applying for a hard money loan. Hard money lenders rely heavily on documentation to evaluate the borrower’s experience and track record. It is imperative that borrowers provide comprehensive and reliable information to paint a clear picture of their qualifications.

7.2 Requested Documentation by Hard Money Lenders

Hard money lenders typically request a range of documents during the application process. These may include a resume or curriculum vitae, financial statements (such as bank statements and income statements), tax returns, documentation of previous real estate investments, credit reports, and property appraisals. Providing these documents allows lenders to conduct a thorough assessment of the borrower’s experience and track record.

7.3 References and Recommendations

In addition to documentation, hard money lenders may request references and recommendations from previous business partners, contractors, or professionals within the real estate industry. These references offer an additional layer of verification and allow lenders to gain insight into the borrower’s working relationships and reputation within the industry.

8. The Interview and Due Diligence Process

8.1 Initial Interview with the Borrower

Once the documentation has been reviewed, hard money lenders often conduct an initial interview with the borrower. This interview serves as an opportunity for lenders to ask specific questions about the borrower’s experience, track record, investment strategy, and financial goals. Additionally, the interview allows lenders to assess the borrower’s communication skills, professionalism, and overall demeanor.

8.2 Verification of Provided Information

Following the interview, hard money lenders undertake a comprehensive verification process to confirm the accuracy of the information provided by the borrower. This may involve contacting references, conducting background checks, and verifying employment or educational history. By verifying the information, lenders can ensure that they are making an informed lending decision based on reliable and accurate data.

8.3 On-Site Property Assessment

Hard money lenders often perform on-site property assessments to evaluate the investment opportunity further. This assessment allows lenders to assess the condition of the property, potential renovation or development costs, and the property’s overall market value. The results of the on-site assessment help lenders gauge the potential profitability of the investment and determine the loan amount and terms.

8.4 Engaging Third-Party Inspectors or Appraisers

To obtain a comprehensive assessment of the property, hard money lenders may engage third-party inspectors or appraisers. These professionals evaluate the property’s physical condition, potential challenges, and market value. Their objective analysis provides lenders with an unbiased perspective on the investment opportunity and helps ensure that the borrower’s projections align with reality.

9. Balancing Experience and Track Record with Other Factors

9.1 Loan-to-Value Ratio

While the borrower’s experience and track record are crucial factors, hard money lenders consider other aspects when evaluating loan applications. One such factor is the loan-to-value (LTV) ratio, which measures the loan amount in relation to the appraised value of the property. Lenders often prefer a lower LTV ratio as it provides a greater margin of safety in the event of default or foreclosure.

9.2 Property Location and Market Conditions

The location of the property and prevailing market conditions also influence the lender’s decision. Hard money lenders assess the desirability and potential appreciation of the property based on its location and local market dynamics. Properties in high-demand areas or in markets with strong growth potential are generally viewed more favorably by lenders.

9.3 Exit Strategy and Repayment Plan

Lenders carefully evaluate the borrower’s proposed exit strategy and repayment plan. Hard money loans are typically short-term, with terms ranging from six months to three years. Lenders assess the borrower’s ability to either sell the property, refinance the loan, or generate sufficient cash flow to repay the loan at the end of the term. An effective and viable exit strategy is essential to lenders, as it ensures the timely repayment of the loan.

9.4 Collateral Assessment

Since the property serves as collateral for hard money loans, lenders conduct a comprehensive assessment of the property’s value and potential as collateral. Appraisals and inspections help determine the market value, condition, and potential risks associated with the collateral property. This evaluation allows lenders to assess the level of risk associated with the loan and make informed decisions regarding loan approval and the loan amount.

10. Conclusion

Hard money lenders evaluate a borrower’s experience and track record as critical factors in the loan approval process. By carefully assessing the borrower’s qualifications, including their industry experience, track record, and ability to navigate challenges, lenders can make informed decisions about lending money for real estate investments. Additionally, hard money lenders consider other factors such as the loan-to-value ratio, property location, exit strategy, and collateral assessment. By balancing experience, track record, and these additional factors, lenders can mitigate their risk and provide financing to borrowers who may not qualify for traditional bank loans.